Apprenticeship Tax

How to allocate your apprenticeship tax to the Institut d'Optique Graduate School in 2024?

Steps:

1. Register on SOLTéA platform, with registration details from net-entreprises.fr

2. Choose the beneficiairies of the remaining balance. You can search using keywords i.e. SIRET, UAI code... The UAI code for the Institut d’Optique Graduate School is: 0910725U.

3. Specify the percentage of the remaining TA that you wish to allocate to the Institut d'Optique.

4. Send the completed allocation form to the Institut d'Optique Graduate School (see attached form).

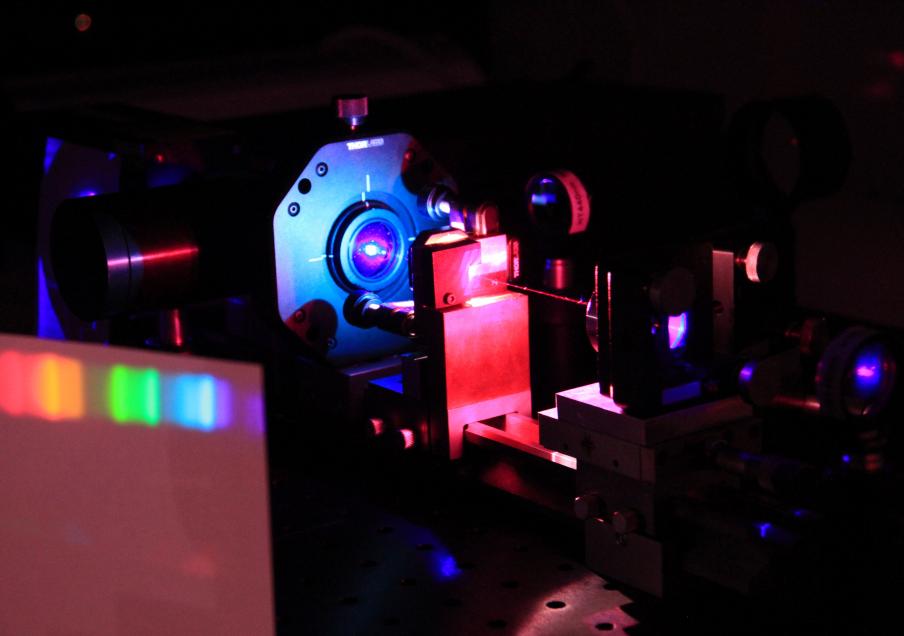

NURTURE THE LEADERS OF TOMORROW

with the Institut d’Optique Graduate School

4 REASONS TO SUPPORT THE INSTITUT D’OPTIQUE GRADUATE SCHOOL

INVEST IN THE TRAINING OF YOUR FUTURE COLLABORATORS

IN 2023 THE APPRENTICESHIP TAX CONTRIBUTED TO NUMEROUS PROJECTS

- Establishing scholarships to encourage international student exchange.

- Strengthening initiatives to encourage young women to pursue careers in science.

- Expanding the use of competency-based learning, learning to better prepare students for the job market.

- Creating hands-on labs and experimental projects addressing industry-relevant problems.

- Enhancing student exchange between campuses to connect with local communities.

- Investing in student engagement through clubs and events (Photonics Forum, Girls Only Supoptique Trophy - GOST…)

To Know More About The Apprenticeship Tax

What is the Apprenticeship Tax?

The apprenticeship tax is a levy imposed on businesses to finance initial vocational and technological training. It is dedicated to all training programs for young people who have not yet entered the workforce.

Who has to pay?

Businesses must pay this tax if they meet the following criteria:

- Have at least one employee

- Be domiciled in France

- Be subject to corporate income tax

How is the apprenticeship tax calculated?

The tax is due from the first year of a company's activity and from the first employee.

The rate is set at 0,68 % of payroll, broken down as follows:

- 87 % for apprenticeship training

- The remaining 13% for "contribution to other vocational training" (Replacing the "hors-quota" portion)

The funds from the 13% portion are used to finance :

- The development of initial technological and vocational training

- The development of professional integration

- The equipment and materials needed for training provided by vocational training centers (CFA)

The Institut d’Optique Graduate School is authorized to collect the 13% "hors-quota" portion on behalf of its engineering school, SupOptique.